Worst of all, achieving financial freedom could appear impossible due to the enormous debt pile that most individuals face. But to conquer debt, it is more often in one’s mind than in one's pocket. There are different ways of thinking new ways of thinking that can dramatically change how you repay the debt and improve your progress toward financial freedom.

Starting a financial freedom journey means more than budgeting or cutting expenses; instead, changing one's perception and relation to money is essential. Being debt-free will change your relationship with money and instill the habit of nurturing long-term health in them.

The problem in every sphere of life should not go unnoticed. Debt isn't only about that number at the bottom of your credit card statement; rather, it is about the missed opportunities and stress you experience. Take the time necessary to add up how much you spend over time in interest and consider what you could do with that money if it weren't lining some creditor's pockets.

In a consumer-driven society, the urge for immediate purchases is sometimes overwhelming. The debt-free mind shows one how to delay gratification. Learn to project your thinking with your financial decisions over a long period. Ask yourself, "Will this contribute toward my long-term financial goals, or does this purchase merely satisfy for now?" It is much easier to say "no" to impulsive spending when you continue to remind yourself of and focus on the satisfaction of financial freedom.

Develop a growth mindset about money: one has to make financial decisions by understanding that one can change and improve through effort and learning. Such a frame of mind opens one up to economic education, learning from past financial mistakes, and gradual improvement in how one handles finances. Again, being debt-free is taking a journey whereby every step can bring new ways of learning and growth.

Of all the changes in focus on repaying our debt, the most relevant ones are reordering and modifying spending behavior. To many of us, this shift in our approach to finances may be the first step in our no-debt quest.

Paying off debt effectively means revisiting your financial priorities and placing debt repayment at the top of your list, even if it means a bit of sacrifice elsewhere. First, look hard at where your money is going and find areas where you can cut back. Every dollar you save is another dollar that can go toward your debt.

Frugality does not have to be about austere living. All it means is that one lives below one's means and finds ingenious ways of cutting costs. Find ways to save money: cook at home instead of eating out, use public transportation, or find free entertainment. Frugality will free up more cash toward your debt but also create habits that will serve you well later in life.

A zero-based budget can be a game-changer in your debt repayment journey. In this particular budgeting approach, some use is assigned to every single dollar earned so that income minus expenses equals zero.

Living without debt requires more than financial sense; it requires tenacious will and resolve. Patience and persistence are the surest allies to living economically independent and help you keep the motivation going despite adversity.

Paying off debt is hard work; it requires changing your perspective from instant gratification to long-term financial health. Keep a picture of your life after being debt-free and the great doors of opportunity it will open for you. This helps when it feels as though progress is very slow and not to give up.

Keep your eyes on the prize, but don't forget to celebrate the little victories. No matter how minuscule, every payment you make brings you closer to the goal. Visualizing your progress by creating a debt payoff picture will put these into perspective.

The basic understanding of paying down debt entails starting over from the ground up. By paying down your debts, you have to prioritize them, even if this means losing something in the process. First, examine your spending habits and see areas where you can save time and money. Saying a dollar saved is one dollar less spent is an excellent and powerful statement that must be lived daily.

Sometimes, debt is a mountain, and one may not know how well they're doing. Moving from that into the mindset that loves small wins will better your motivation and alter your journey to be focused and energized for the whole period. You need to acknowledge your achievements whenever you pay off debts, no matter how small. This helps in reinforcing psychological factors.

In the human brain, recognizing progress, even for small steps, fires off dopamine. This neurotransmitter strengthens positive behavior, making one more likely to continue with their debt repayment schedule. Every time you celebrate a milestone in consciousness, you train your brain to associate debt payoff with pleasure, not pain or sacrifice.

Chop how you’ll be repaying your debt into small serviceable portions. Instead of thinking about the significant, general, massively distant goal, make new goals that you can achieve weekly or monthly. They recommended that individuals decide to celebrate after accomplishing incremental goals, such as when they have saved half a thousand dollars or remained loyal to the budgeting process for one whole month. The minor victories prove that there is action in your cause, and the accumulation of such forms a momentum.

Do not forget that success starts in the head. However, as you commence to declare war on your debt, it might help you to see debt as a temporary problem best suited prepared for by embracing financial education, patience to try and try again, and small victories as the best way to approach this war.

TOP

TOP

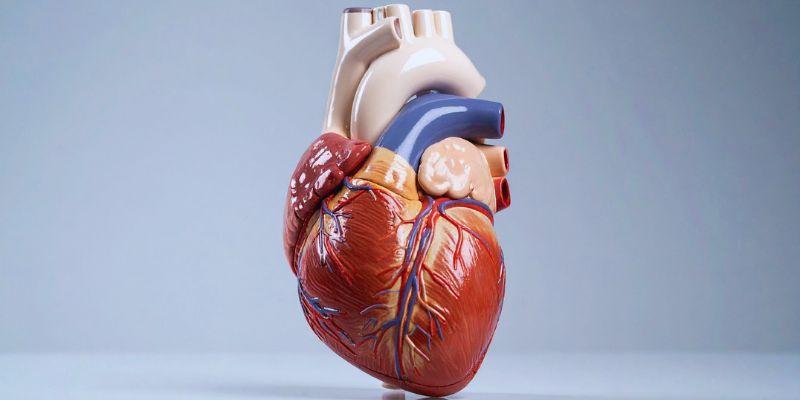

If you still believe that women don’t get heart diseases or that only older people can have heart diseases, you are wrong

TOP

TOP

How building wealth is possible at any age with practical strategies that focus on consistent habits, smart choices, and long-term thinking

TOP

TOP

Start making the most of your 401(k) today and secure a stronger financial future. Learn how timing, employer matches, and smart contributions can improve your retirement

TOP

TOP

How financial aid for college works—from grants and scholarships to loans and work-study programs. Get clear, practical guidance for every funding option

TOP

TOP

Discover 5 unique horse races that take place around the world, blending speed, thrill, and stunning cultural locations.

TOP

TOP

Discover how Easter is celebrated across countries, from egg rolling to water fights, offering joy through local traditions.

TOP

TOP

Explore North Wales’ most breathtaking gardens, from serene floral paths to hillside greenery with sea views.

TOP

TOP

Wondering if it’s the right time for a loan? Learn how rates, timing, and your finances impact the decision.

TOP

TOP

Discover the top reasons to pay credit card bills on time and how it safeguards your credit, money, and peace of mind.

TOP

TOP

Uncover the best experiences in Rome, Italy, with this essential guide. Walk through ancient ruins, explore piazzas, visit historic churches, and get to know the Eternal City at your own pace

TOP

TOP

Discover the best places to stay in Nashville, from lively downtown hotels to charming neighborhood rentals. Explore top areas suited for music lovers, families, and anyone seeking the perfect Nashville experience

TOP

TOP

Thinking about a lease buyout? Learn how to evaluate your options, compare costs, and decide whether keeping your vehicle is the right move. Understand the financial side before making your next step