In 2025, personal finances will be more important to manage. The lack of stability in the economy, inflation, and the complexity of financial products have necessitated bringing back budgeting as a way of ensuring that people achieve financial stability so that they achieve the goals they set out to achieve. Fortunately, budgeting apps have revolutionized money management—providing powerful, real-time tools to track spending, optimize savings, and plan for future expenses, all within an intuitive digital interface.

In 2025, personal finances will be more important to manage. The lack of stability in the economy, inflation, and the complexity of financial products have necessitated bringing back budgeting as a way of ensuring that people achieve financial stability so that they achieve the goals they set out to achieve. Fortunately, budgeting apps have revolutionized money management—providing powerful, real-time tools to track spending, optimize savings, and plan for future expenses, all within an intuitive digital interface.

The proper budgeting app can take your fiscal integrity to the next level because, by automating the menial work and providing more individual feedback, as well as helpful patterns, it can help you make your everyday choices coherent with your long-term plans. This article explores the best budgeting apps for 2025, emphasizing functionality, ease of use, data security, and affordability to help you make an informed choice.

Budgeting apps are software solutions designed to help individuals and families track income and expenses, categorize spending, set budget limits, and monitor financial health over time. They generally integrate with bank accounts, credit cards, loans, and investment accounts to import the transaction information and to prominently display a net worth picture in real time.

The Mint from Intuit has continued to be popular with the masses on personal budgeting because of its multi-faceted approach and free price tag.

Yet, it is also ideal as a basic app suited to novices and less experienced users because, unlike its competitors, Mint does not require any setup and is entirely free to use.

NAB has adopted the zero-based budgeting philosophy that allocates each dollar to a purpose to help avoid overspending.

NAB has adopted the zero-based budgeting philosophy that allocates each dollar to a purpose to help avoid overspending.

The agenda-like attention of NAB is ideal for those who are willing to take their budgets seriously and are serious about taking charge of their finances.

PocketGuard is easy to use; you are informed how much you can afford to spend.

In My Pocket” Feature: Computes the amount of disposable income that is left after bills, goals, and necessities.

Most suitable in the case of a user who does not wish to spend a lot of time building a budget to limit the expenditures.

Besides being an investment management tool, Personal Capital is also a comprehensive budget and cash flow tracking tool.

This is best suited to people who combine budgeting with wealth and investment management.

Goodbudget is based on the envelope budgeting mechanism; hence, it assists in allotting money to various spending envelopes.

A good pick of those who like to have a hands-on budgeting process and families that like to get involved in finances.

Consolidation with Financial Accounts

Easy to Use and Design

Customizability

Data Security

Customer Support and Education Material

Real-Time Spending Attention

Living Your Financial Goal

Debt Management

Time Saving and Organization

Better Robustness on Alfred Martin

Artificial and Machine Learning

Ethical Spending and Sustainability Recommendations

Automated Savings

Multi-User and Family Features

Financial systems of modern times require a robust budgeting application, more so because individual finance is becoming complicated. The best budgeting apps 2025, like Mint, YNAB, PocketGuard, and Personal Capital, provide diverse features tailored to varying needs and preferences.

With a budgeting app incorporated into your everyday life, you get to understand where your money goes, how to manage it, and breathe with ease because you're not going broke with your finances and gaining permanent financial control.

TOP

TOP

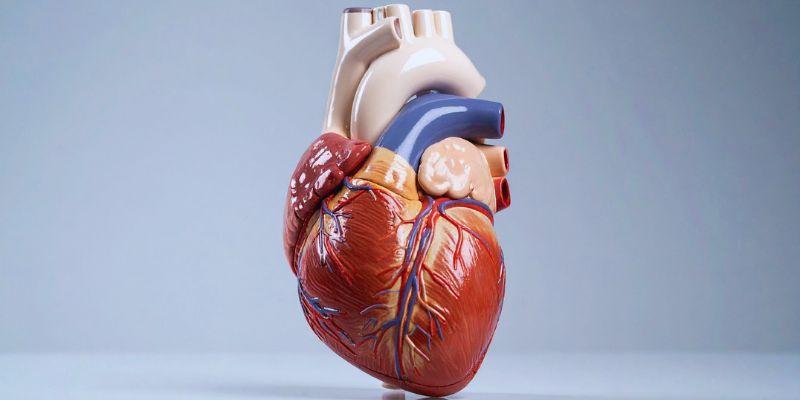

If you still believe that women don’t get heart diseases or that only older people can have heart diseases, you are wrong

TOP

TOP

How building wealth is possible at any age with practical strategies that focus on consistent habits, smart choices, and long-term thinking

TOP

TOP

Start making the most of your 401(k) today and secure a stronger financial future. Learn how timing, employer matches, and smart contributions can improve your retirement

TOP

TOP

How financial aid for college works—from grants and scholarships to loans and work-study programs. Get clear, practical guidance for every funding option

TOP

TOP

Discover 5 unique horse races that take place around the world, blending speed, thrill, and stunning cultural locations.

TOP

TOP

Discover how Easter is celebrated across countries, from egg rolling to water fights, offering joy through local traditions.

TOP

TOP

Explore North Wales’ most breathtaking gardens, from serene floral paths to hillside greenery with sea views.

TOP

TOP

Wondering if it’s the right time for a loan? Learn how rates, timing, and your finances impact the decision.

TOP

TOP

Discover the top reasons to pay credit card bills on time and how it safeguards your credit, money, and peace of mind.

TOP

TOP

Uncover the best experiences in Rome, Italy, with this essential guide. Walk through ancient ruins, explore piazzas, visit historic churches, and get to know the Eternal City at your own pace

TOP

TOP

Discover the best places to stay in Nashville, from lively downtown hotels to charming neighborhood rentals. Explore top areas suited for music lovers, families, and anyone seeking the perfect Nashville experience

TOP

TOP

Thinking about a lease buyout? Learn how to evaluate your options, compare costs, and decide whether keeping your vehicle is the right move. Understand the financial side before making your next step