The Great Recession, which began in late 2007 and lasted through 2009, was a global economic downturn that significantly impacted businesses, governments, and individuals. Rooted in the collapse of the housing market and financial institutions, it caused widespread unemployment and financial instability. Understanding its causes, consequences, and recovery efforts provides crucial insights into maintaining economic resilience in the future.

The Great Recession originated in the early 2000s, when the United States experienced a housing boom, accompanied by a rise in the economy. Mortgage lending was high with interest rates maintained at a low level by the Federal Reserve after the downturn experienced at the beginning of the 2000s. With a strong interest in their profits, the lenders resorted to the issuance of high-risk loans to borrowers who did not correspond to the usual standards of creditworthiness.

Such subprime loans, also known as adjustable-rate mortgages, were made by bundling them into mortgage-backed securities and selling them off to institutional investors. It is assumed that there will always be growth in prices of housing and thus reducing the risk of default.

When the housing bubble burst, it exposed more pronounced structural woes in the entire financial system of the world. Financial institutions had gotten themselves into massive amounts of leverage - they had borrowed a ton of money to invest in risky securities. Their balance sheets were wiped out when the value of these assets went down.

One of the single most vivid incidents in the crisis was in September of 2008, when Lehman Brothers, the fourth-largest investment bank in the USA, filed for bankruptcy. This was the biggest bankruptcy in American history, and this sent a chilly message to international markets. Panic seized hold, and there was a liquidity crisis as none wanted to lend, not even peers.

The financial crisis that caused the trouble quickly extended to the economy. America officially slipped into recession in December 2007, and when the recession finally ended in the middle of 2009, the harm was enormous. In the United States alone, more than 8.7 million jobs were lost, and the peak of unemployment, 10% of the population, occurred in October 2009.

The housing market kept falling apart. The house prices had gone down across the country, and almost four million foreclosures were initiated in 2009. Many people who owned homes ended up finding themselves under water, possessing mortgages, and the mortgages were more than the value of their homes.

Faced with a rapidly deteriorating financial and economic landscape, governments and central banks initiated an array of emergency measures. In the United States, the Federal Reserve cut interest rates to near zero and launched several rounds of quantitative easing — large-scale asset purchases designed to inject liquidity into the system and encourage lending.

Simultaneously, Congress passed the Troubled Asset Relief Program (TARP), authorizing $700 billion to stabilize banks and prevent further collapses. This marked a turning point in crisis management, as the government stepped in to assume an active role in the financial markets.

Additionally, fiscal stimulus measures were enacted to support the real economy. The American Recovery and Reinvestment Act of 2009, valued at over $800 billion, aimed to stimulate demand through infrastructure projects, aid to state governments, and direct support to individuals and businesses.

In the aftermath of the crisis, there was a clear recognition that major regulatory reform was necessary. The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in 2010, was the most comprehensive overhaul of U.S. financial regulation since the 1930s.

Key provisions of the law included:

Globally, similar efforts were undertaken. The Basel III framework was introduced to strengthen international banking regulations, mandating higher capital buffers and more rigorous risk assessments.

These reforms aimed not only to fix what had gone wrong but to make the financial system more resilient to future shocks.

The human toll of the Great Recession extended well beyond economic metrics. Families lost their homes, individuals lost lifelong savings, and many workers — particularly younger and less educated individuals — faced long-term setbacks in employment and income growth.

The recession also widened income inequality. While wealthier individuals and corporations recovered relatively quickly, millions struggled with stagnant wages and reduced opportunities. Trust in major institutions — from banks to regulatory agencies — eroded, fueling broader social and political discontent.

Moreover, the prolonged recovery had lasting impacts on fiscal health. Government debts soared as tax revenues declined and stimulus spending increased. Policymakers in many countries faced difficult choices in balancing support for growth with concerns about fiscal sustainability.

Despite the immense challenges, the global economy eventually rebounded. In the United States, growth resumed in mid-2009, though the recovery was slow by historical standards. It took six years for the job market to regain pre-recession employment levels.

Stock markets recovered more quickly, but wage growth remained subdued for much of the 2010s. Business investment returned cautiously, and housing markets eventually stabilized, though some regions took much longer to recover.

In many countries, structural reforms and fiscal adjustments were necessary to rebuild confidence. The emphasis on stability, regulation, and transparency helped strengthen financial institutions and prevent a recurrence of the same crisis dynamics.

The Great Recession left policymakers, economists, and citizens with several enduring lessons:

The Great Recession was a defining moment in 21st-century economic history. What began as a housing market correction evolved into a global financial meltdown, reshaping the world’s economic architecture. Through decisive intervention, regulatory reform, and gradual rebuilding, recovery was achieved — but not without immense cost.

TOP

TOP

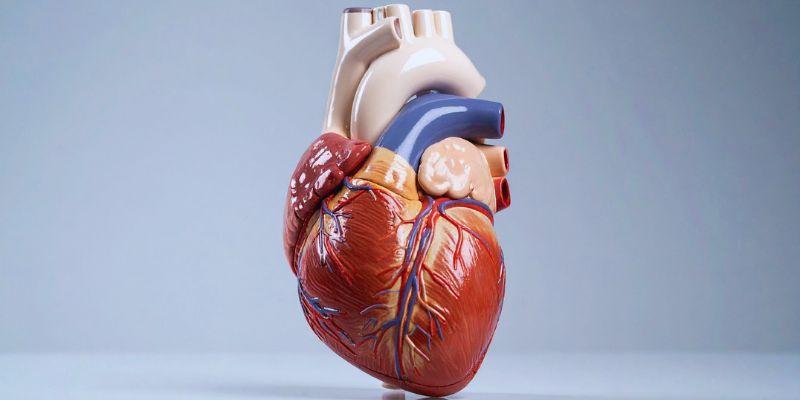

If you still believe that women don’t get heart diseases or that only older people can have heart diseases, you are wrong

TOP

TOP

How building wealth is possible at any age with practical strategies that focus on consistent habits, smart choices, and long-term thinking

TOP

TOP

Start making the most of your 401(k) today and secure a stronger financial future. Learn how timing, employer matches, and smart contributions can improve your retirement

TOP

TOP

How financial aid for college works—from grants and scholarships to loans and work-study programs. Get clear, practical guidance for every funding option

TOP

TOP

Discover 5 unique horse races that take place around the world, blending speed, thrill, and stunning cultural locations.

TOP

TOP

Discover how Easter is celebrated across countries, from egg rolling to water fights, offering joy through local traditions.

TOP

TOP

Explore North Wales’ most breathtaking gardens, from serene floral paths to hillside greenery with sea views.

TOP

TOP

Wondering if it’s the right time for a loan? Learn how rates, timing, and your finances impact the decision.

TOP

TOP

Discover the top reasons to pay credit card bills on time and how it safeguards your credit, money, and peace of mind.

TOP

TOP

Uncover the best experiences in Rome, Italy, with this essential guide. Walk through ancient ruins, explore piazzas, visit historic churches, and get to know the Eternal City at your own pace

TOP

TOP

Discover the best places to stay in Nashville, from lively downtown hotels to charming neighborhood rentals. Explore top areas suited for music lovers, families, and anyone seeking the perfect Nashville experience

TOP

TOP

Thinking about a lease buyout? Learn how to evaluate your options, compare costs, and decide whether keeping your vehicle is the right move. Understand the financial side before making your next step